Customer Payment Terms (SAF-710)

Step-by-step Guideline

This procedure describes how you can record details of payments that have been made to customers in the Sense-i System so that the reports displaying outstanding customer balances and cash flow reports are accurate.

-

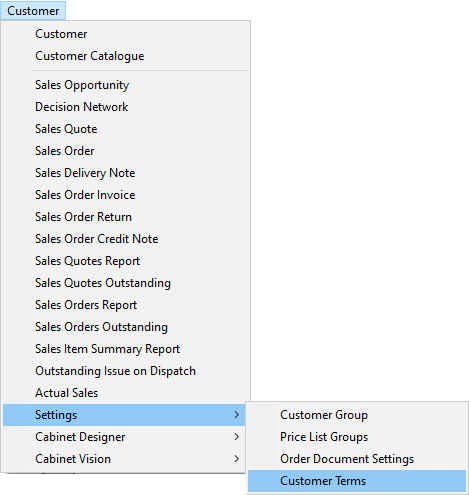

Click on the Customer item on the Main Menu.

-

Click on the Settings item on the drop down menu.

-

Click on the Customer Terms menu item from the side pop-up menu.

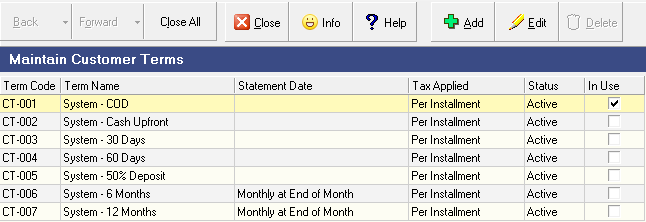

The system will display a screen titled Maintain Customer Terms.

This screen lists all of the Payment Terms that have been previously defined

for Customer Accounts and captured in the system.

Add Customer Payment Terms

- To Add a new Customer Payment Term to the database, click the Add button on the form bar.

The system will display a screen titled Add Customer Terms.

This screen allows you to define a new Payment Term to be saved in the system

database.

-

In the Term Name field type in a name that describes the details of the payment terms.

-

Decide when the Tax due on the transaction is to be applied. Either this is as each installment is paid or all the tax is applied on the final installment. Select the appropriate option from the drop down list in the Tax Accrual field.

-

If the payment terms are based on a statement date, then define the date on which the statement is sent. For example, the 25th of each month. If the payment terms are based on a number of days from the invoice date, then leave this field blank.

-

Click the Save button.

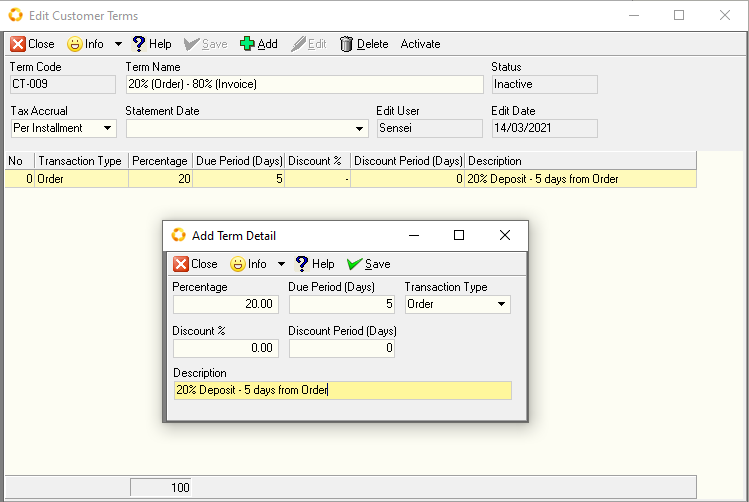

Specify Term Detail

- To specify the Term details, click the Add button.

The system will open a screen titled Add Term Detail. This screen enables you to enter information about the terms that are used by the system to calculate the cash flow for all customer payments.

Customer payment terms consist of the following

-

Percentage of total transaction value.

-

The number of days from the transaction date (either order, invoice or statement) by which the percentage receivable must be paid.

-

The Transaction Type on which the delay to the payment date is calculated.

-

If any discount is granted when the payment is made, then the percentage discount given is entered in this field.

-

The number of days (Discount Period - Days) within which payment must be received for the discount to be applied.

For most customers you would apply simple terms such as 100%, 30 days from statement.

As an example, assume the terms are 20%, 5 days from Order.

In other words, if the customer placed an order for R 10,000 on the 15th of

March, you would expect a payment of R2,000 within 5 days, on/before

the 20th of March.

This is essential if you transact with customers who are required to pay a deposit or

partial payment when you sell goods or services to them.

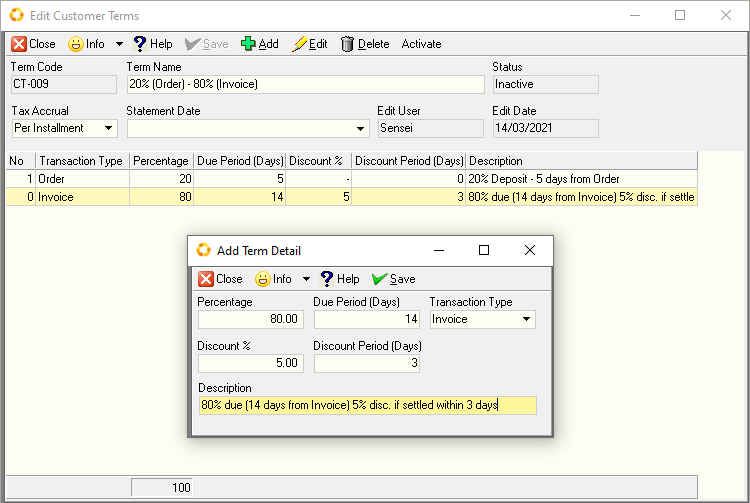

In this example the outstanding amount of R8,000 would need to be received within 14 days from the date of invoice.

If the invoice is settled within 3 days a discount of 5% would apply.

- Once you have entered all the details about the terms click the Save button on the form bar.

Transaction Type

-

If the payment terms are based on a statement, then the date on which the statement is normally run is entered in this field. If the payment terms are based on the date of order or invoice, then this field is left blank.

-

Payment Split (If you require the customer to pay a percentage on order, and a different percentage on delivery and then maybe on statement, you can enter this information in this field.)

-

Tax - If the Tax is required on each portion of the transaction then leave the Tax Accrual field as Per Installment.

If Tax is only expected on the last transaction, then select Last Entry.

This is the end of this procedure.