Maintain Account Groups (SAF-1911A)

Outline - Account Groups

Managing the financial heart of any business requires that the

information about transactions in the business is stored and presented

in a way that allows for easy, yet intelligent analysis.

Ensuring that financial information is properly structured from the

beginning is central to making this possible.

All General Ledger Systems store and report on a huge number of individual transaction entries. To provide meaning to all these individual transactions General Ledgers group and sum financial information in individual accounts. These accounts are maintained in a Chart of Accounts function.

In most cases, the number of accounts in the average Chart of Accounts

is lengthy, usually running into the hundreds.

The problem with so many different accounts is that analysing and

managing the financial performance of a business becomes

un-necessarily complicated and often, while there is an abundance of

information, it is neither practical nor useful for making the right

decisions.

To solve this problem, the Accounts in the Chart of Accounts are arranged into Financial Statements, and within each Financial Statement, into specific Account Groups.

The Account Groups allow you to arrange and analyse the financial information of your business in a quick and powerful way so that you can identify and replicate successful areas and at the same time take the necessary steps to identify and control any variances.

Financial Statements

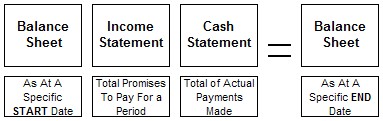

At the top of the structure are the Financial Statements of which there are three types.

- Balance Sheet

- Income Statement

- Cash Statement

Balance Sheet

The Balance Sheet measures the status or structure of property at a specific time. A Balance Sheet is a "snapshot", like a still photograph, it a reflects the total balance of assets, money owed by its customers, money owed to suppliers, employees and financiers and the difference between the organization's assets and the money it owes (called the liabilities). This difference is known as the Net Worth of the organization.

The status or position of a company's financial position on the balance is the result of the trading (Sales less Expenses) and the flow of cash (Collections less Payments) in a given period. The information about a company's trading is reported on an Income Statement. (This is also sometimes called a Profit and Loss Statement).

Income Statement

The Income Statement is a record of Legal Obligations, that is "promises to pay in the future." It is extremely important to note that the values reflected on the Income Statement are not a reflection of the Cash Transactions of an organization.

Sales are promises from the company's customers to pay for the goods and services they have bought. Expenses are promises by the company to pay its suppliers for the materials, machinery and facilities it has purchased. Payroll expenses are promises by the company to pay its employees for the work they have performed. In addition, the Income Statement is also a record of how quickly it is utilizing other assets, such as machinery. The financial values assigned to the Depreciation record how much value a tangible asset has been lost through use during a period.

Cash Statement

The Cash Statement records the actual flow of money in the company, that is the value of the payments, receipts, interest charges and so on, made and received.

When customers actually settle their accounts, the cash they pay appears as Collections on the company's Cash Statement. When the company makes actual payments of money to its Employees, Suppliers and the Government, the value of these payments appear in various Account Groups on the Cash Statement. The Direct Cash Statement chronicles what flows in and out of the organization's bank accounts.

The three financial statements provide a complete picture of the status of a company's financial position and the changes from one date to another. As such, it is best to think of the three financial statements using the following illustration...

Account Groups

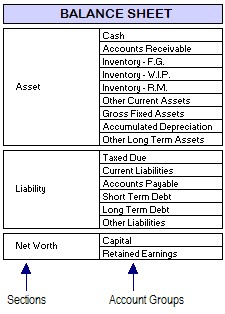

Each Financial Statement is broken down into a set of Account Groups that sum the financial information for similar types of transactions together. The Account Groups provide a high level view of what is happening in a business. The Balance Sheet is broken down into three sections. These are...

- Assets

- Liabilities

- Net Worth (being the difference between Assets and Liabilities)

Within each of these sections are a set of Account Groups that relate specifically to the section.

Assets

The Assets of a business can be categorised as follows:

-

Cash (how much money the company has in its bank accounts.)

-

Accounts Receivable (how much money its customers owe for goods and services bought.)

-

Inventory (how much stock of finished goods, work-in-progress and raw materials it has.)

-

Other Current Assets (items it owns that can be quickly converted into cash.)

-

Fixed Assets (the machinery, buildings and equipment it owns.)

-

and finally Other Assets.

Liabilities

Similarly, the Liabilities section on the Balance Sheet, (that is what the company owes other companies and individuals), can be arranged according to meaningful groups.

-

Taxes Due (the amount owed to various tax authorities.)

-

Current Liabilities (the amount owed to staff and sundry parties.)

-

Accounts Payable (the amount owed to suppliers for goods bought.)

-

Short Term Debt (the value of loan payments due in the coming 12 months)

-

Long Term Debt (the value of loans outstanding less the Short Term portion).

Net Worth

The Net Worth of a company can be arranged into...

-

Share Capital (the value of the money invested in the shares of the business)

-

Retained Earnings (the value of the historical profit made by the company)

The following image illustrates the breakdown of the Balance Sheet into its sections and Account Groups...

Income Statement

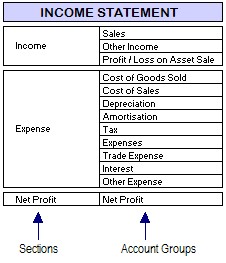

In a similar way, the Income Statement is broken down into two sections which themselves are arranged into various Account Groups.

Income

-

Sales (the value of the goods and services bought by the company's customers in a period.)

-

Other Income (the value of money earned from other assets such as shares in a period.)

-

Profit on Asset Sale (the profit made on the sale of fixed assets in a given period.)

Expenses

-

Cost of Goods Sold (the cost of the goods and services sold to customers in a period.)

-

Cost of Sales (the cost of making and supporting sales in a period.)

-

Depreciation (the cost of machinery and equipment used in a period.)

-

Amortisation (the cost of the use of other assets in a period.)

-

Tax (the value of tax due to be paid in a period.)

-

Expenses (the cost of personnel incurred by a company in a period.)

-

Trade Expenses (the cost of goods and services purchased from suppliers in a period.)

-

Interest (the cost of the loans and debt finance used by the company in a period.)

-

Other Expenses (the cost of any sundry expenses in a period.)

-

Net Profit (the difference between the income and all the expenses in a period.)

The following image illustrates the breakdown of the Income Statement into its sections and Account Groups...

Cash Statement

The Cash Statement similarly is broken down into three sections each of which consists of several Account Groups.

Custom Account Groups

The Sense-i General Ledger System allows you to view the Account Groups and to create customized names for each Account Group if you need names for Account Groups that are different from the standard ones included with the system.

Create Custom Account Groups

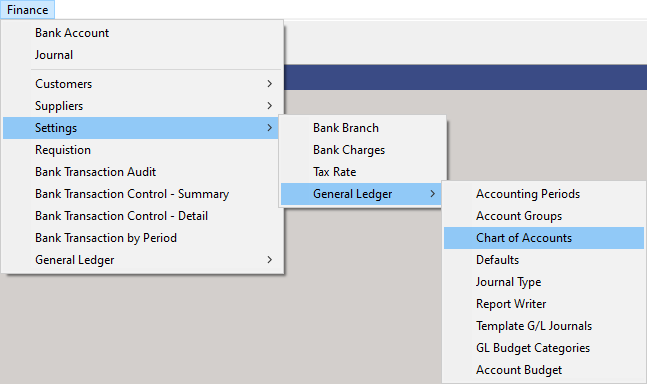

To view and create custom Account Group Names, perform the following steps...

-

Click on the Finance option on the Main Menu.

-

Then click the Settings menu item on the drop down menu.

-

Then click General Ledger and then Chart of Accounts.

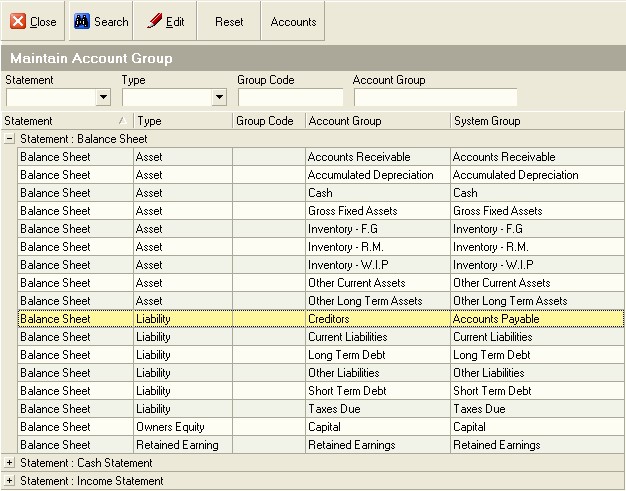

The system will open a screen titled "Maintain Account Group."

This screen lists all of the standard Account Groups that have been

pre-defined in the system.

You can search for specific Account Groups using any of the fields in the Search Criteria Panel at the top of the screen.

-

To create a custom name for an Account Group, click on the Account Group for which you wish to create a custom Account Group name

-

Then click the Edit Button at the top of the screen.

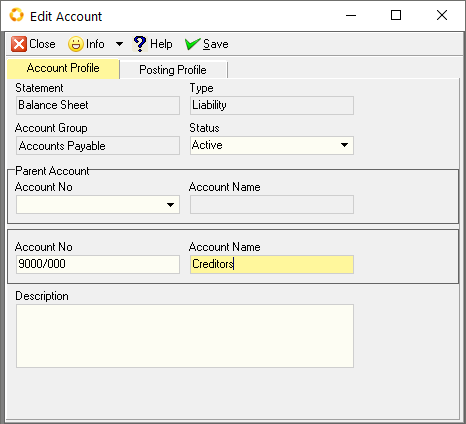

The system will open a window titled "Edit Account Group."

You can enter a code for the Account Group, create a custom Account Group Name

or enter a Description for the Account Group in any of the fields on

the screen.

-

You might decide that you wish to see the word "Creditors" on your financial statements instead of the term "Accounts Payable." To do this, type the Custom Account Group Name you wish to use in the Account Group field.

-

Once you have made the necessary changes, click the Save button.

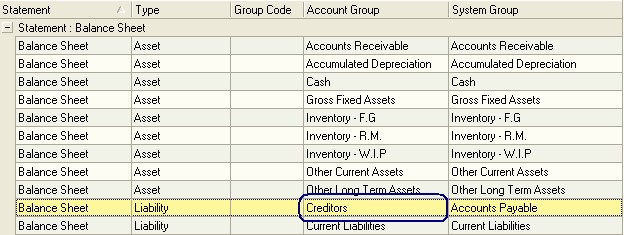

The system will close the Edit Account Group window and return you to the list of Account Groups.

You will notice that the Custom Account Group Name you have entered will be displayed in the Account Group column. Notice too that the original system defined Account Group Name is displayed in the System Group column.

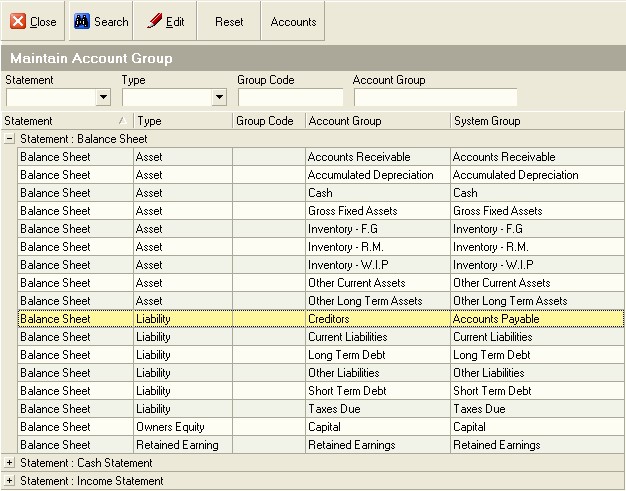

Reset Custom Account Group Name

- If you need to reset the Custom Account Group Names to the original ones defined by the system, click the Reset Button.

- Once you have completed working with the Account Groups click the Close button.

This is the end of the procedure.