Define General Ledger (G/L) Posting Rules (SAF-1912A)

Procedure Guideline

Use this procedure to capture details for posting transactions in the company's General Ledger.

In this procedure you will link various business objects to one or more accounts in the company's Chart of Accounts as they are defined in the General Ledger. The system will use the linked accounts to decide how to post transactions from the various sub-ledgers when they are imported into the General Ledger.

The Business Objects

The system uses the following Business Objects in creating transactions and recording financial information;

- Parties

- Customers, Suppliers, Employees, Financiers and Legislators

- Products & Services

- Taxes

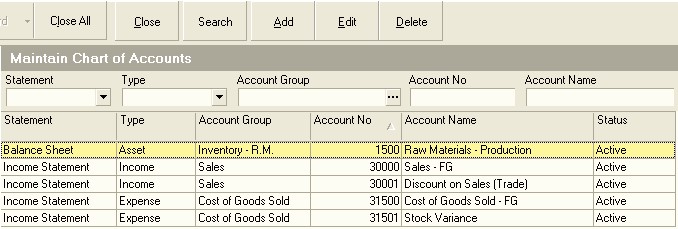

- Bank Accounts

Before you can set up the Posting Rules for your various Inventory Items you will need to at least have the following accounts defined in your General Ledger.

G/L Posting Rules for Customers

An Accounts Receivable Control Account in the Accounts Receivable Account Group on the Balance Sheet to which the value of all Sales Order Invoices, Sales Order Credit Notes and Customer Receipts in the Bank Account will be posted.

A Delivery Note -- Invoice Clearing Account in the Accounts Receivable Account Group on the Balance Sheet to which the value of all Sales Order Delivery Notes will be debited and Sales Order Invoices will be credited.

A Settlement Discount in the Sales Account Group on the Income Statement to which the value of all the discount granted to Customers will be posted.

G/L Posting Rules for Suppliers

An Accounts Receivable Control Account in the Accounts Receivable Account Group on the Balance Sheet to which the value of all Sales Order Invoices, Sales Order Credit Notes and Customer Receipts in the Bank Account will be posted.

A Delivery Note -- Invoice Clearing Account in the Accounts Receivable Account Group on the Balance Sheet to which the value of all Sales Order Delivery Notes will be debited and Sales Order Invoices will be credited.

A Settlement Discount in the Sales Account Group on the Income Statement to which the value of all the discount granted to Customers will be posted.

G/L Posting Rules for Inventory Items

There are 5 different account groups that need to be linked to each Process Type.

These are the

-

Procurement Account (this setting controls which to which account the amount is posted when a purchase takes place),

-

the Cost of Goods Sold Account (this setting controls to which account the cost of the item is posted when it is sold),

-

the Sales Account (this setting controls to which account the selling price of the item is posted when it is sold),

-

the Trade Discount Account (this setting controls to which account any discount on purchase is posted) and finally

-

the Stock Variance Account (this setting controls to which account any discrepancies arising from stock takes are posted).

Procurement

An Inventory Account on the Balance Sheet for all items on the Process Type Printed List that are to be treated as Stock Items.

A Trade Expense Account on the Income Statement for all items on the Process Type Printed List that will be treated as an Expense.

A Finished Goods Account on the Balance Sheet to which the value of all manufactured items (i.e. the Outputs of Process Orders) will be allocated.

Cost of Sales / Cost of Goods Sold

A Cost of Sales Account on the Income Statement to which the Standard Cost of items on Sales Order Delivery Notes will be allocated.

Sales

A Sales Account on the Income Statement to which the Selling Price After Discount of all products and services sold to Customers will be posted in the General Ledger.

Trade Discount

A Discount Account on the Income Statement to which any Trade Discount against List Price (not Discount Received on early payment) will be allocated.

Stock Variance

A Stock Variance Account on the Income Statement to which all Stock Count Variances and Revaluations will be allocated on Stock Adjustment Transactions.

G/L Posting Rules for Taxes

A Tax Control Account in the Taxes Due Account Group on the Balance Sheet to which the tax portion of all transactions will be posted.

G/L Posting Rules for Bank Accounts

A Bank Control Account in the Cash Account Group on the Balance Sheet to which all transactions from the company's cashbooks or bank accounts will be posted.

A Bank Charges Account in the Expenses Account Group on the Income Statement to which all bank charge transactions from the company's cashbooks will be posted.

G/L Posting Rules at System Level

For Work In Progress

A Work In Progress Account on the Balance Sheet to which all Materials issued from the Store will be captured as Process Order Issue transactions.

For Customers

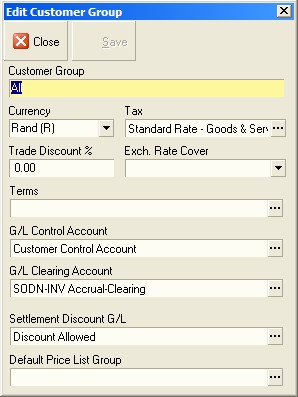

For each Customer defined in the system, you need to define a link to three different Accounts in the General Ledger Chart of Accounts.

The system enables you to set this information at a Customer Group level so that you do not have to define this for each Customer you capture in the system. By linking the profile for an individual Customer to a Customer Group, the system will use the General Ledger Accounts defined at the Customer Group level.

A. Define the Customer Control Account in this field.

B. Define the Delivery-Invoic Clearing Account in this field.

c. Define the Settlement Discount Account in this field.

Customer General Ledger Control Account

The first account you need to set is the G/L Control Account. This is the Account in the Accounts Receivable Account Group on the Balance Sheet to which the Balance Owing to the company by its Customers will be posted. The accounts in the Accounts Receivable Account Group therefore store the Total Value of all Unpaid Customer Invoices and confirms how much money the company is owed by its Customers.

Sales Delivery Note - Invoice Clearing Account

The second is the G/L Clearing Account. This is the Account that the system will use to ensure that the value of all Sales Order Delivery Notes made out for goods delivered to Customers correspond with the Sales Order Invoices sent to Customers.

When a company delivers goods to its customers, invoices are not always sent Customers at the same time. To deal with this, you capture Sales Order Delivery Notes for the deliveries made to customers as one step in the process. In the General Ledger, the system will debit a SODNSOINV Clearing account, instead of debiting the Customers Control Account.

Then, at the appropriate time, you will create a Sales Order Invoice and the system will credit the SODN-SOINV Clearing account with the original value of the SODN and debit the Customer's Control Account with the value of the invoice.

You will need to define which account is used to clear the Sales Order Delivery Notes to the Sales Order Invoices. Ideally, this should be an account that is part of the Accounts Receivable Account Group on the Balance Sheet.

Settlement Discount Account

The third and final account to which you need to link the Customer Account Group is the Settlement Discount Account.

This is the account that is used by the system to store the value of all the discount granted to Customers when making payment in time to qualify for discount.

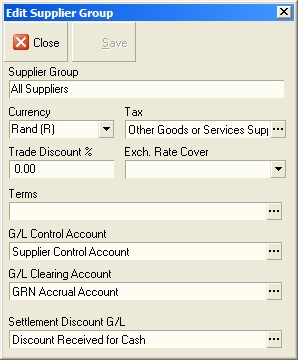

For Suppliers

For each Supplier defined in the system, you need to define a link to three different Accounts in the General Ledger Chart of Accounts.

The system enables you to set this information at a Supplier Group level so that you do not have to define this for each Supplier you capture in the system. By linking the profile for an individual supplier to a Supplier Group, the system will use the General Ledger Accounts defined at the Supplier Group level.

A. Define the Supplier Control Account in this field.

B. Define the POREC-Invoice Clearing Account in this field.

C. Define the Settlement Discount Account in this field.

Supplier General Ledger Control Account

The first account you need to set is the G/L Control Account. This is the Account in the Accounts Payable Account Group on the Balance Sheet to which the Balance Owing to Suppliers will be posted. The Accounts Payable Account Group therefore stores the Total Value of all Unpaid Supplier Invoices and confirms how much money the company owes to its Suppliers.

Goods Received - Invoice Clearing Account

The second is the G/L Clearing Account. This is the Account that the system will use to ensure that the value of all Purchase Order Receipts corresponds to Purchase Order Invoices.

When suppliers deliver goods to the company they do not always provide invoices at the same time. To deal with this, you capture the deliveries made by suppliers in the system using a Purchase Order Receipt (this is also known as a Goods Received Note or GRN). As suppliers deliver goods you enter quantities and cost prices of the items delivered as a Purchase Order Receipt transaction. In the General Ledger, the system will credit a POREC-POINV Clearing account, instead of crediting the Supplier's Control Account. Once the invoice is received form the supplier, you capture the invoice in the system as a Purchase Order Invoice transaction. The system debits the POREC-POINV Clearing account with the original value of the POREC and credit the Supplier Control Account with the value of the supplier invoice.

You will need to define which account is used to clear the POREC to the POINVs. Ideally, this should be an account that is part of the Accounts Payable Account Group on the Balance Sheet.

Settlement Discount Account

The third and final account to which you need to link the Supplier Account Group is the Settlement Discount Account.

This is the account that is used by the system to store the value of all the discount taken when making payments to suppliers.

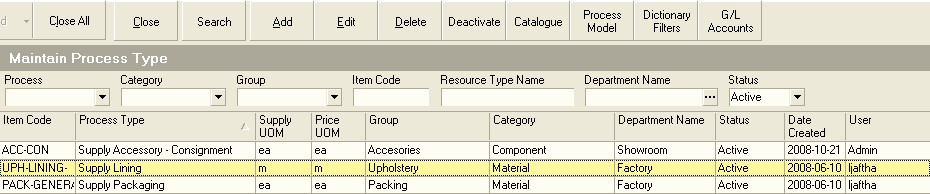

For Inventory Items

For each of the inventory item types in the system you will need to define the General Ledger Posting Rules.

-

Click on Inventory on the main menu.

-

Click Settings on the drop down menu.

-

Then select Process Types from the side menu.

The system will display a list of all of the Process Types that have been captured in the Sense-i system. You will need to define and capture the General Ledger Accounts to which transactions against each of these Process Types need to be recorded in the General Ledger module. Once you have captured the accounts in the General Ledger Chart of Accounts you can proceed with the steps outlined below.

It is a good idea to print this list, define the General Ledger Accounts and then tick the rows off on this list as you successfully define the appropriate General Ledger Accounts.

-

Click a row containing the name of the Process Type for which you wish to define General Ledger Accounts.

-

Click the G/L Accounts button on the form bar.

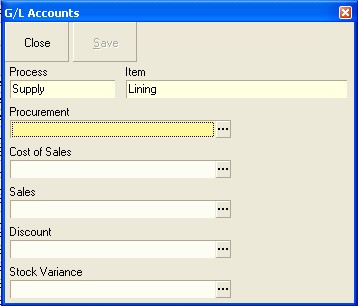

The system will display the G/L Accounts Posting Rule table. This screen lists a series of fields that allow you to look-up and then select appropriate accounts from your company's Chart of Accounts.

Each of the fields has a label that identifies it's purpose in terms of posting transactions to the General Ledger.

Procurement

The account you select in the Procurement field will be the account to

which the net cost of a Purchase will be allocated. For an item that is

a Stock Item, this will usually be a Balance Sheet Account in the

Inventory Account Group.

For an item that is an Expense item, this will usually be an

Income Statement Account in one of the Expense Account Groups.

These accounts will usually be debited on the completion of a Purchase Order Receipt transaction, which is also sometimes called a Goods Received Note or GRN.

If the item is a manufactured item, then this account will be debited when the Process Order (or Job) that is making the item is marked as complete.

Cost of Sales

The account you select in the Cost of Sales field will be the account to which the standard cost or average cost of an item will be assigned when completing a Sales Order Delivery Note. This will usually be an account in the Cost of Sales Account Group on the Income Statement.

Sales

The account you select in the Sales field will be the account to which the Net Selling Price Excluding Tax will be assigned when completing a Sales Order Delivery Note. This will usually be an account in the Sales Account Group on the Income Statement.

Discount

The account you select in the Discount field will be the account to which any TRADE DISCOUNT (that is discount that is granted on the order) will be posted.

This is not the Settlement Discount.

Stock Variance

The account you select in the Stock Variance field will be the account to which changes made in terms of physical stock count or stock valuation changes will be posted in the General Ledger.

Make sure that you have the following in place:

If you want to define the General Ledger Accounts in greater detail, then for each of these accounts you can define accounts at the Product, Component or Material Group or Type Level. You could of course also use a completely different method of allocating transactions in the General Ledger that does not match your Product, Component or Material Group or Type architecture. As a tip, it is usually fine to have a single account in the General Ledger to which all the transactions are allocated and then to obtain a more detailed breakdown of these transactions from the various operational reports in the Sense-i System.

Once you have defined the Accounts to which to Post Transactions for the various Inventory Items in your system, you need to define the Accounts to which to Post the Creditors and Debtors totals on each transaction.

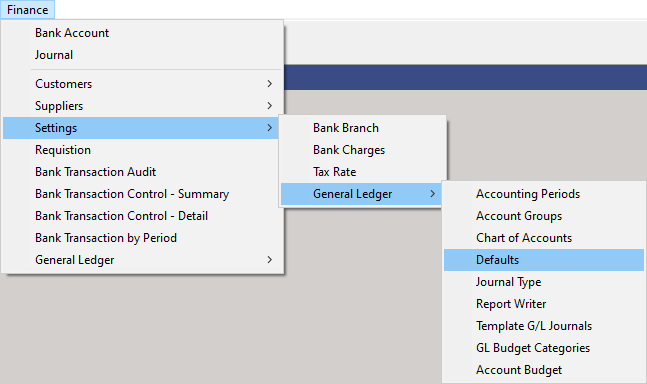

Default G/L Posting Rules at System Level

The following default accounts from the Chart of Accounts need to be defined at the system level.

To access this screen...

-

Click Finance on the main menu.

-

Click on Settings on the drop down menu.

-

Click General Ledger from the side menu and then select Defaults.

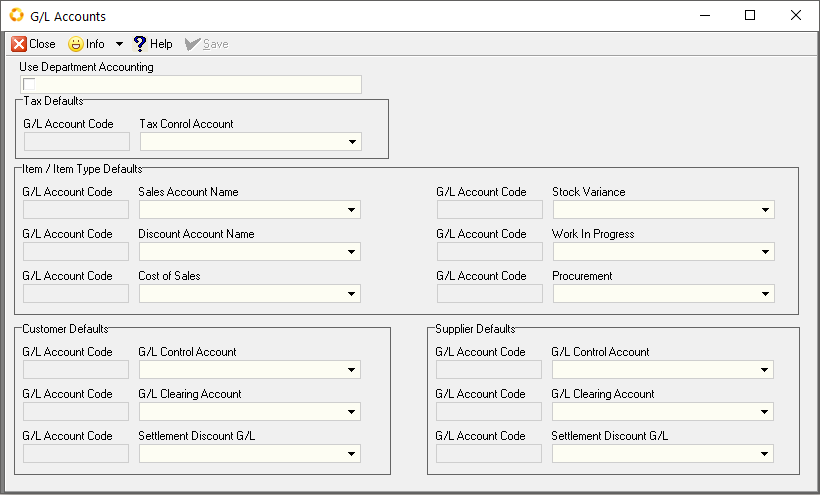

The system will display the G/L Accounts Default Settings window.

You will need to define the following default accounts for the system.

Departmental Accounting

Select Use Departmental Accounting when you have more than one department in your company and you want the system to automatically allocate all transactions to the applicable department.

Work In Progress

A Work In Progress Account on the Balance Sheet to which all Materials issued from the Store will be captured as Process Order Issue transactions.

Settlement Discount

A Settlement Discount Account on the Income Statement to which all Discounts given to customers on processing customer receipts will be posted.

A/P-POREC Clearing

An A/P-POREC Clearing Account on the Balance Sheet. This is a clearing account to which all supplier deliveries (Goods Receipt Notes or Purchase Order Receipts) are posted and to which all supplier invoices (Purchase Order Invoices) are posted. This account should be zero at the end of each period and any balance on this account indicates that either Supplier Invoices have not been captured or that there is a difference between the value of goods received and invoices received from Suppliers.

A/R-SODN Clearing

An A/R-SODN Clearing Account on the Balance Sheet. This is a clearing account to which all goods sold to customers (Sales Order Deliveries Notes) are posted and to which all customer invoices (Sales Order Invoices) are posted. This account should be zero at the end of each period and any balance on this account indicates that either Customer Invoices have not been generated or that there is a difference between the value of goods delivered and invoiced to Customers.

Tax Control

A Tax Control Account on the Balance Sheet as a default account to which all Taxes Due in the form of VAT are posted.

This is the end of this procedure.