Maintain Default Posting Accounts (SAF-1912)

Step-by-step Guideline

-

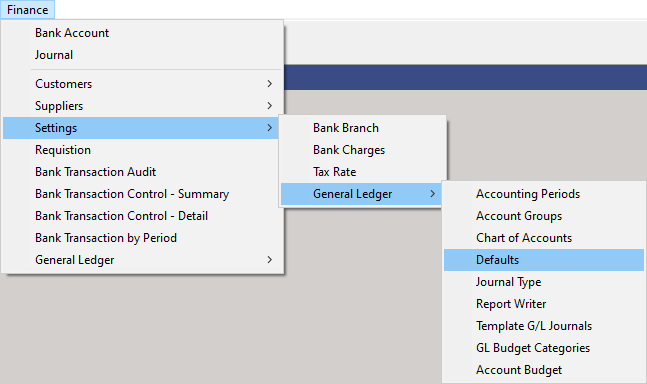

Click on the Finance option on the Main Menu.

-

Then click the Settings menu item on the drop down menu.

-

Then click General Ledger and select Defaults.

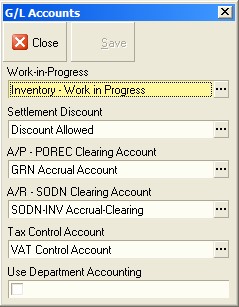

The system will open a screen titled "G/L Accounts." This screen lists all of the Accounts that have been defined in the General Ledger.

Setting Up The Default Accounts

You will set-up each of the Default Accounts in the same way.

This is described in steps 5 to 7 below...

- To select an Account to act as the Default Posting Account, click on the three dot button in each of the Default Account fields as described below.

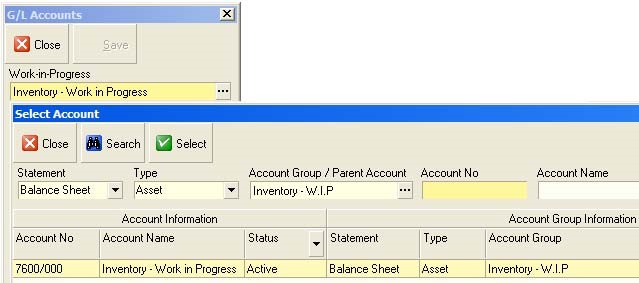

The system will open a window allows you to click on an Account from your Chart of Accounts list.

You can use the any of the Search Fields at the top of the screen and the Quick Filter List described above to filter the list if you need to do so.

-

Once you have found the Account you wish to use, click on the appropriate row.

-

Then click the Select button.

The system will return you to the Default G/L Account window and display the Account Name of the Account you have selected in the Default Account panel.

You will then repeat these steps for each of the Default Accounts you need to define for your company.

Understanding The Purpose Of Each Default Account

The Work-in-Progress Account

This is a default account used for storing the financial value of all materials that are issued from the material stores to process orders.

The balance of the account is increased by the Process Order Issue transaction, that is materials booked out of the store.

The balance of the account is reduced by the Process Order Issue Return transaction, that is all materials returned from production (or operations or construction, depending on your company) to the store.

The balance on the account is also influenced by the value of materials in completed process orders. As process orders are completed the balance in the Work-In-Progress account is reduced because by completing a process order (or job) the materials are moving from production into a Finished Goods store or to the Customer.

You should set up a Work In Progress on the Balance Sheet in the Inventory -- Work-in-Progress account and then select this account as the default.

Settlement Discount

This is a default account used for storing the financial value of all Discount Taken when paying accounts. Any discount journals or discounts recorded on a payment to a supplier is stored in this account.

You should set up a Discount Allowed account in the Income Statement in the Other Income Account Group and then select this account as the default.

A/P - POREC Clearing Account

This is the Accounts Payable -- Purchase Order Receipt Clearing Account. The term POREC (Purchase Order Receipt) and GRN (Goods Received Note) are completely interchangeable.

This is a default account used to ensure that the Invoices received from Suppliers correspond to the Goods Delivered.

The balance on this account is increased by the Purchase Order Receipt transaction that is created to process deliveries received from Suppliers. (note that the Purchase Order Receipt transaction is sometimes known as a Goods Received Note.)

The balance of this account is decreased by the Purchase Order Return transaction that is created to process any items returned to suppliers.

In addition, Purchase Order Invoices and Purchase Order Credit Notes update the balance on this account.

The Purchase Order Invoice will decrease the balance on this account as it offsets the Purchase Order Receipt values.

The Purchase Order Credit Note will increase the balance on this account as it offsets the Purchase Order Return transaction.

You should set up a GRN Clearing Account on the Balance Sheet in the Accounts Payable Account Group and then select this account as the default.

A/R - SODN Clearing Account

This is the Accounts Receivable - Sales Order Delivery Note Clearing Account.

This is a default account used to ensure that the Customers are Invoiced for all deliveries made to them.

The balance on this account is increased by the Sales Order Delivery Note transaction that is created whenever goods are delivered to customers.

The balance of this account is decreased by the Sales Order Return transaction that is created to process any items returned by Customers to the company.

In addition, Sales Order Invoices and Sales Order Credit Notes update the balance on this account.

The Sales Order Invoice will decrease the balance on this account as it offsets the Sales Order Delivery Notes values.

The Sales Order Credit Note will increase the balance on this account as it offsets the Sales Order Return transaction.

You should set up a A/R -- SODN Clearing Account on the Balance Sheet in the Accounts Receivable Account Group and then select this account as the default.

Tax Control Account

This is a default account used to store the value of the tax component on all Sales, Purchases and Sundry Bank transactions.

You should set up a default Tax Account on the Balance Sheet in the Taxes Due Account Group and then select this account as the default.

Departmental Accounting

The final default setting for the General Ledger is the Departmental Accounting. Check this box if your company has more than one factory, warehouse or retail outlet and you wish to allocate and report on income and expenditure separately for each department.

Once you have defined the Default Accounts you need, click Save and the Close.

The system will Close the Default G/L Accounts screen and return you to the main screen in the application.

This is the end of the procedure.