Supplier Payment Terms (SAF-720)

Step-by-step Guideline

This procedure describes how you can record details of payments that have been made to suppliers in the Sense-i System so that the reports displaying outstanding supplier balances and cash flow reports are accurate.

-

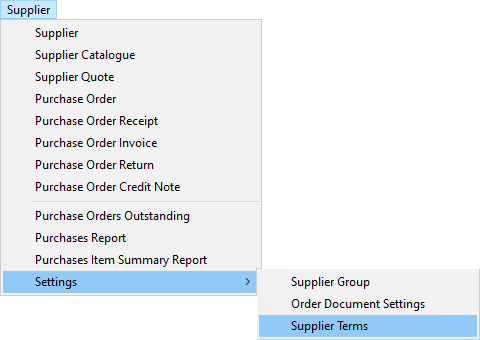

Click on the Supplier item on the Main Menu.

-

Click on the Settings item on the drop down menu.

-

Click on the Supplier Terms menu item from the side pop-up menu.

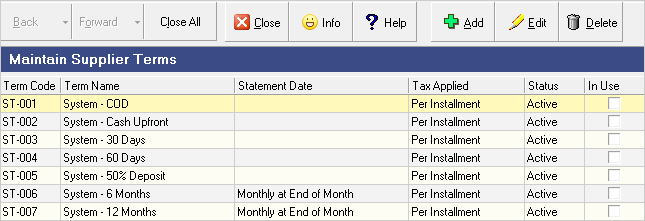

The system will display a screen titled Maintain Supplier Terms.

This screen lists all of the Payment Terms that have been previously defined

for Supplier Accounts and captured in the system.

Add Supplier Payment Terms

- To Add a new Supplier Payment Term to the database, click the Add button on the form bar.

The system will display a screen titled Add Supplier Terms.

This screen allows you to define a new Payment Term to be saved in the system

database.

-

In the Term Name field type in a name that describes the details of the payment terms.

-

Decide when the Tax due on the transaction is to be applied. Either this is as each installment is paid or all the tax is applied on the final installment. Select the appropriate option from the drop down list in the Tax Accrual field.

-

If the payment terms are based on a statement date, then define the date on which the statement is received. For example, the 25th of each month. If the payment terms are based on a number of days from the invoice date, then leave this field blank.

-

Click the Save button.

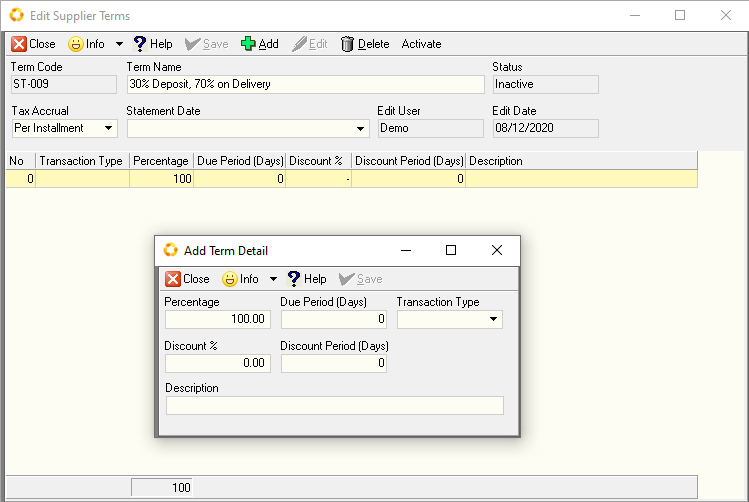

Specify Term Detail

- To specify the Term details, click the Add button.

The system will open a screen titled Add Term Detail. This screen enables you to enter information about the terms that are used by the system to calculate the cash flow for all supplier payments.

Supplier payment terms consist of the following

-

Percentage of total transaction value payable.

-

The number of days from the transaction date (either order, invoice or statement) by which the percentage payable must be paid.

-

The Transaction Type on which the delay to the payment date is calculated.

-

If any discount is granted when the payment is made, then the percentage discount given is entered in this field.

-

The number of days (Discount Period - Days) within which payment must be made for the discount to be applied.

Most suppliers will apply simple terms such as 100%, 30 days from statement.

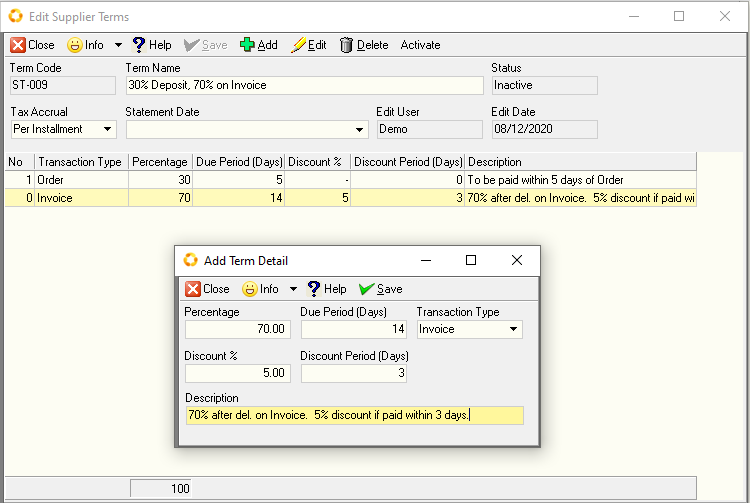

As an example, assume the terms are 30%, 5 days from Order.

In other words, if you placed an order for R 3,000 with a supplier on the 18th of

January, you would need to make a payment of R900 within 5 days, on/before

the 23rd of January.

This is essential if you transact with suppliers who require a deposit or

partial payment when you purchase goods or services from them.

In this example the outstanding amount of R2,100 would need to be paid within 14 days from the date of invoice.

If the invoice is settled within 3 days a discount of 5% would apply.

- Once you have entered all the details about the terms click the Save button on the form bar.

Transaction Type

-

If the payment terms are based on a statement, then the date on which the statement is normally run is entered in this field. If the payment terms are based on the date of order or invoice, then this field is left blank.

-

Payment Split (If the supplier terms allow you or require you to pay a percentage on order, and a different percentage on delivery and then maybe on statement, you can enter this information in this field.)

-

Tax (If the Tax is payable on each portion of the transaction then leave the Tax block blank. If Tax is only payable on the last transaction, then place a tick in this block.)

This is the end of this procedure.